Choosing a fiduciary to look after your financial resources and carry out your wishes is a critical aspect of estate planning. The attorneys at Baker Law can assist by serving as trustee or executor for you and your beneficiaries.

A fiduciary will assist in managing your assets and provide the proper administration of your estate after you are gone.

The fiduciary is one of the oldest recognized relationships in our legal system. When serving as trustees, the attorneys at Baker Law will carefully manage and protect your assets, distribute income and principal according to your trust documents and applicable trust laws, and provide accurate and timely activity reporting.

Baker Law attorneys often serve as trustees of revocable trusts alongside clients who have created and funded trusts to benefit themselves when alive or others after their death.

Our fiduciary services draw on the extensive experience of our attorney-trustees who coordinate outside investment managers, brokers, back office support, and leading trust accounting technology to provide a highly personalized client experience.

The attorneys at Baker Law are honored to fill trustee or executor roles because we consider this work our highest calling.

Commonly Asked Questions About Fiduciaries

Why do lawyers make effective trustees?

Our lawyers and staff undergo training in the nuances of trust law, estate and charitable planning, taxation, real estate, business planning, probate law, and estate settlement. Those skills, along with a sense of personal responsibility, are the hallmarks of a good trustee. At Baker Law, our attorneys have considerable experience serving as trustees.

Explain your philosophy and approach?

As trustees, we strive to enhance and preserve the value of each client’s assets. Achieving that objective and building a family’s wealth requires maintaining a long-term perspective, measuring success over several years rather than a few fiscal quarters. It also calls for a disciplined approach, focusing on companies with histories of growing earnings and strong balance sheets.

In most cases, a trust’s investment objectives lead us to structure a diversified portfolio across various asset classes and industry and economic sectors, offering the prospect for substantial growth in earnings and value over time. When we get involved in developing a client’s overall estate and financial plan, we also consider the client’s real estate holdings, business interests, personal property, life insurance, and retirement plan assets.

How do you make investment decisions?

At Baker Law, we do not offer investment advice. Instead, we rely on registered investment advisory firms that guide trusts, foundations, and other family enterprises. Unlike banks or trust companies, we can work with a client’s current investment advisor—preserving that relationship for the family while still using professional trustee services. We tailor unique, comprehensive investment and trust management policies that guide each trust’s decisions.

Typically, we prefer that our trusts‘ equity positions include stocks. Individual stock purchases avoid front and back-end load fees and internal operating charges associated with mutual funds. In addition, personal stock portfolios enable us to control the realization of taxable income in each of our trusts. We seek high-quality management, transparent earnings, socially responsible products, low debt, and shareholder accountability.

We hold cash in money market funds that invest in U.S. Treasury issues, and we purchase risk-free high-quality government and corporate bonds to help preserve liquidity. Where appropriate, we also use municipal bonds, real estate investments, venture capital opportunities, and other alternative investments.

In addition to our outside investment counsel, we avail ourselves of investment information and advice from various other sources. Often, we meet periodically with independent investment professionals who share their experiences and opinions with us.

How do you deliver trust services?

We are responsible for safekeeping trust assets, collecting and distributing income, processing securities transactions, and maintaining necessary account records. We employ leading technology and custodial providers to deliver first-class, institutional-grade services. Our long-term relationships allow us to obtain institutional—rather than retail—pricing on investment advisory, custodial, brokerage, and other financial services generally unavailable to clients. We strive to pass those savings on to our trusts. Our fees are transparent; we do not accept referral fees, commissions, “soft dollars,” or other hidden compensation. Regardless of whether a trust holds stocks, bonds, real estate, personal property, or retirement assets, our fiduciary services include:

- Customized reporting

- Easy-to-understand client statements

- Income projection reports

- Investment performance reports

- Timely distributions of income and principal

- Bill paying

- Gift processing

- Completing discretionary distributions to beneficiaries

- Conducting family meetings

- Preparing trust tax returns

- Providing secure online access to trust information

Do you work with my other trusted advisors?

Yes. Our trustees will work directly with your accountant, financial planner, life insurance agent, and other professional advisors to integrate the various components of your financial plan.

Helpful Resources

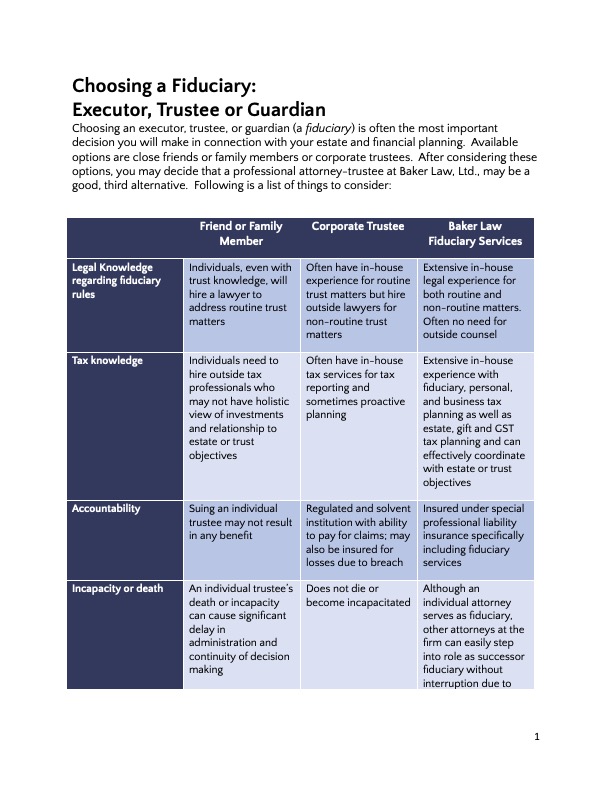

Choosing a Fiduciary: Executor, Trustee, or Guardian

Choosing an executor, trustee, or guardian (a fiduciary) is often the most important decision you will make in connection with your estate and financial planning. Here is a list of things to consider.